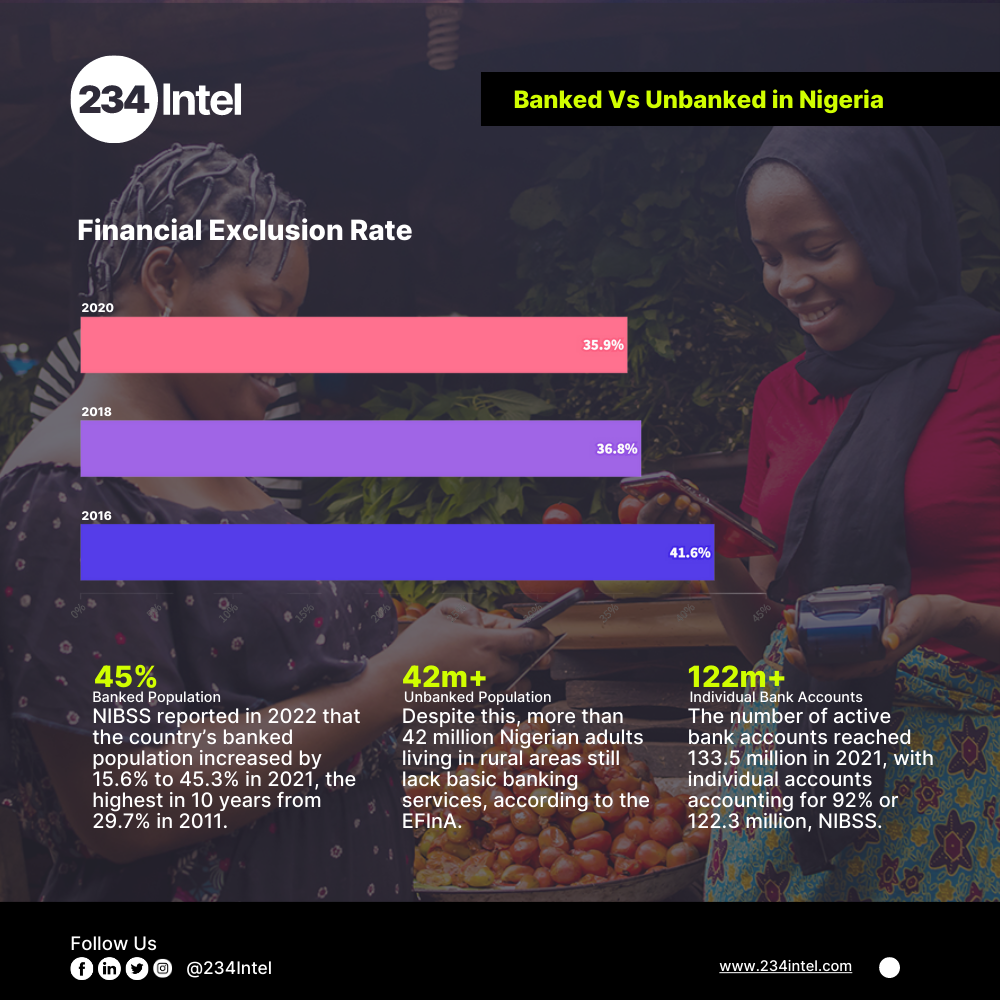

As at 2020, only 51% of Nigeria’s population had formal access to financial services. This indicates a need for greater access to financial services for the Nigerian population.

Today, about 36% of Nigeria’s adult population currently conduct financial transactions outside the banking system (Source: EFInA). This means approximately 59 million Nigerians depend on cash to facilitate daily transactions. This gives a clear picture why cashless policies executed today will cause so much chaos.

In recent years, there has been an increase in the use of digital financial services and agent networks in Nigeria. However, despite these advancements, only 45% of Nigerians have bank accounts, with financial exclusion being more prevalent in rural areas. This means that a large number of Nigerians are still unable to access essential financial services, such as loans, savings accounts, and insurance.

The growth of mobile banking, agent banking, and digital financial services has made it easier for people to access financial services, but more needs to be done to ensure that all Nigerians have access to these services. By improving access to financial services, Nigeria can promote economic growth and development, reduce poverty, and improve the standard of living for its citizens.

Until financial inclusion is significantly improved in Nigeria, implementing a cashless economy will always be met with significant resistance.

Look out for our 234 Intel’s 2023 Fintech Report coming soon!